报名截止日期

2024年12月1日23:59

EAC,全称Economics Asia Convention,即亚洲经济学大会。EAC,由IE0日本组委-金融知力普及协会、IE0中国澳门组委-礼仕培育基金,及IE0中国区创始、成功举办前四届IEOC活动的ITCCC联手,联合东京大学、香港大学等权威学术单位专家共同发起,这不仅是一场专属于亚太区域的高水平经济学活动,更是向对经济学与商科满怀激情的中学生发出的荣耀召集令!

首届EAC国际站已于2024年3月在日本成功举办,来自中国香港、澳门,以及日本、阿联酋、泰国、新加坡等多个国家和地区的IEO精英代表与高中财经商界新星,齐聚东京。他们踏入具有历史意义的第18届奥运会会址-NYC国立奥林匹克纪念青少年综合中心,完成了一场为期7天的智慧碰撞与文化交融之旅。

2024年12月1日23:59

英文

组委会线上统一组织,学生限时完成题目作答

经济学基础较强,对经济学、商科、金融兴趣浓厚的12年级及以下中学生

2025年1月23日(周四)17:00-18:30(90分钟限时作答)

500元/人,含学术资料、活动答疑、题目命制、线上组织、注册平台、电子证书制作等

- 4人制团队形式参与(报名截止前队内成员应完成报名和队友填写;不足4人团队将自动转为个人形式) - 个人形式参与

水平测试 中国站 国际站(日本东京)

4人制团队形式参与/个人形式参与

设备自测:1月17日(周五)至1月22日(周日)

正式测试:2025年1月23日(周四)

测试形式:在线考试,限时1.5小时

题目类型:30道客观选择题

题目语言:英文

测评知识点:经济学70%/商学15%/金融知识15%,详见《中国区学术大纲》

活动时间:2025年2月7日-10日

活动地点:中国·北京

参与方式:

水平测试表现优异团队或个人将获邀

核心环节:

1)经济学进阶知识测评(Economics):个人

2)商业项目路演(Business Case):团队

活动时间:2025年3月23日-29日,7天

活动地点:日本·东京

参与方式:中国站表现优异者获邀

核心环节:

1)Economics:个人独立,限时180分钟答题

2)Business Case:5人团队制商业项目路演

3)东京大学课程学习;4)日本当地文化交流

2025年EAC经济活动报名截止至2024年12月1日23:59,如需报名参加活动,请抓紧时间!

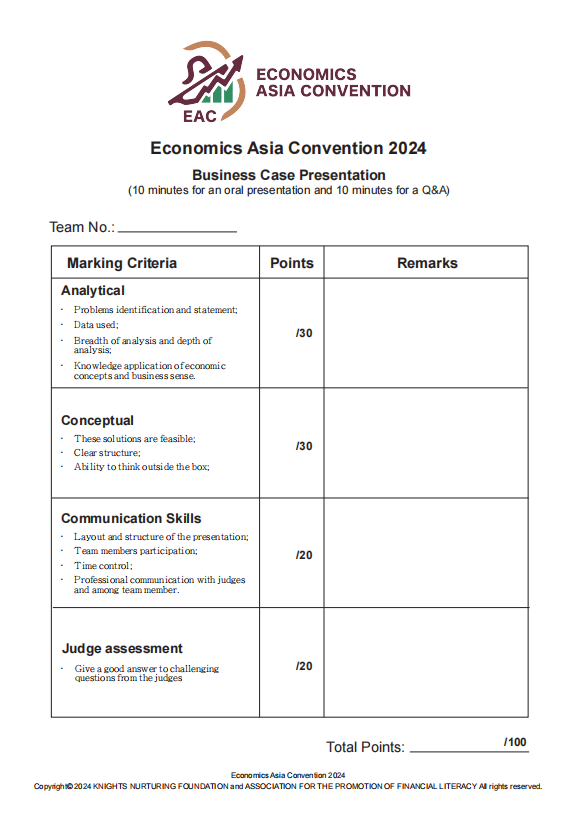

团队学术表现:以所有挑战团队的“团队成绩”排名

• HIGH DISTINCTION:Top 10%

• DISTINCTION:Top 10%-30%

• MERIT:Top 30%-50%

• PARTICIPANT: 50%~

个人学术表现:以全体挑战者“个人成绩”排名

• HIGH DISTINCTION:Top 10%

• DISTINCTION:Top 10%-30%

• MERIT:Top 30%-50%

• PARTICIPANT: 50%~

EACC在线水平测试证书:每位学生均将获得电子证书

领取真题

个人学术表现: 以经济学进阶知识测评中的“个人成绩”排名

• CHAMPION

• 1ST RUNNER-UP

• 2ND RUNNER-UP

• HIGH DISTINCTION:Top 10%

• DISTINCTION:Top 10%-30%

• MERIT:Top 30%-50%

• PARTICIPANT: 50%~

个人综合学术表现:个人成绩50%+团队成绩50%

• EXCELLENCE IN OVERALL INDIVIDUAL PERFORMANCE:Top 10

团队学术表现: 以商业项目路演的“团队成绩”排名

• CHAMPION

• 1ST RUNNER-UP

• 2ND RUNNER-UP

• HIGH DISTINCTION:Top 10%

• DISTINCTION:Top 10%-30%

• MERIT:Top 30%-50%

• PARTICIPANT: 50%~

中国站学术表现证明:

• 所有到场挑战者将获得一份电子学术表现证书,以表彰他们在活动中的努力和

成果;

• 表现优异挑战者现场将被授予奖牌、奖杯等;

• 若团队中有队员在选拔日缺席,将仅根据实际参加的队员成绩进行计分。

中国队组建:将从中国站中遴选10位挑战者,组建代表队,于3月下旬飞赴日本东京,参加2025年EAC亚洲经济学大会国际站。 直通获邀:个人综合卓越表现(Top 10)得主将获得直通邀请资格 候选人:High Distinction及以上个人和团队进入侯选人行列

报名后可获得如下学术资料:EAC CHINA Syllabus(知识大纲)+样题(题目训练)+推荐阅读资料(在基础上补充提高)+教学视频(知识点梳理)

Problem 1 Isocost and Isoquant curve

Isocost curve of the producer is similar to budget constraint line of the consumer and isoquant curve of the producer is similar to indifference curve of the consumer, and the intersection of the isocost curve and isoquant curve shows the situation of producer equilibrium.

Based on the above information, answer the questions:

- If the equation of isoquant 16K1/4 L3/4 =2144 depicts the different combinations of inputs K and L that can be used to produce a specific level of output Q=2144, calculate and explain the marginal rate of technical substitution at K=256, L=108. (20 points)

- Analyze the substitutional effect and income effect for Giffen goods if the price of the goods decreases by using the budget constraint line and indifference curve. (10 points)

Key points and scoring guide:

1、If the equation of isoquant 16K1/4 L3/4 =2144 depicts the different combinations of inputs K and L that can be used to produce a specific level of output Q=2144, calculate and explain the marginal rate of technical substitution at K=256, L=108. (20 points)

d/dL (16K1/4 L3/4) =d/dL (2144)

12 K1/4 L-1/4 +4K-3/4 L3/4 *dK /dL =0

dK /dL =-3K/L

at K=256, L=108, MRT= -3(256)/108= -7.11

This means that if L is increasing by 1unit, K will decrease by 7.11 unit in order to remain on the production isoquant where the production level is constant.

2、Analyze the substitutional effect and income effect for Giffen goods if the price of the goods decreases by using the budget constraint line and indifference curve. (10 points)

When the price of Giffen goods decreases, the income effect will offset the substitution effect, and consumers will finally buy less of the products. Graphs needed to be drawn.

Problem 2 Quantitative easing

Since the financial crisis of 2008, the Fed, the Bank of England and other central bank started to lower interest rate by using the open market operation to reach the target interest rate and world economy tends to recover. However, the world-wide dissemination of Covid-19 made the world economy into serious recession and the central bank of world started to use the quantitative easing to stimulate the economy.

Based on the above information, answer the questions:

1、Analysis how the central bank uses the reverse repo and repo to control the money supply? (10 points)

2、Analysis how the central bank uses the traditional open market operation and quantitative easing to stimulate the economy out of the recession? (10 points)

3、If central bank uses open market operation or QE to decrease interest rate, even to negative interest rate, it might lead to capital gains on securities owned by commercial banks, but on the other hand, the profit margin of commercial bank might decrease. Explain whether the capital gains earned will overweight the loss in profit margin by the commercial banks? (10 points)

Key points and scoring guide:

1、Repo: The central bank is using the - repo to lend money to the public temporally and send short-term liquidity to the market to stimulate the economy.

Reverse repo: The central bank is using the reverse repo to decrease the temporary liquidity in the economy.

In China, the repo and reverse repo has the opposite definition to that of the U.S and UK.

2、Analysis how the central bank uses the traditional open market operation and quantitative easing to stimulate the economy out of the recession? (10 points)

The traditional open market operation is that central bank buys or sell the short-term security, normally government bond, to stimulate the economy or control the inflation. When the central bank carries open market buying, it tends to increase the money supply and lower the interest rate without enlarging the balance sheet of central bank. The open market operation of purchase government is likely to be used when the central bank can still buy the short-term security to lower the target interest rate until zero lower bound.

The quantitative easing is an open-market operation in which bonds are purchased by a central bank in order to increase the quantity of excess reserves held by commercial banks and thereby hopefully stimulate the economy by increasing the amount of lending undertaken by commercial banks, when federal fund rates are near zero. Buying a lot of long-term security with the money generated by the central bank through enlarging the balance sheet of central bank is to relieve large amount of liquidity when the economy is in deep recession to give much confidence to economy in deep recession. However, it might lead to higher inflation.

3、If central bank uses open market operation or QE to decrease interest rate, even to negative interest rate, it might lead to capital gains on securities owned by commercial banks, but on the other hand, the profit margin of commercial bank might decrease. Explain whether the capital gains earned will outweigh the loss in profit margin by the commercial banks? (10 points)

When the interest rate goes down, the price of security owned by the central bank is likely to increase, then the commercial bank might get benefit from the capital gain.

However, deposit rates of the banks might be competitive among different banks, so the credit rate declines to great extent than deposit rates, causing the profit margin for commercial bank to shrink.

The decline of today’s value of future profits might outweigh the capital gain because the decline of today’s value of future profit might deteriorate the bank’s overall capital position, its lending abilities might also decrease. In this case, the capital gains earned might be less than the loss in profit margin.

Lower interest rate might have opposite effects on bank capital. There is a positive effect due to the increase in the value of long-term assets. On the other hand, there is a negative effect on profitability. So, the final effect might depend on which effect is stronger than the other.