- 翰林提供学术活动、国际课程、科研项目一站式留学背景提升服务!

- 400 888 0080

Edexcel A Level Economics A:复习笔记4.5.2 Taxation

Progressive, Proportional & Regressive Taxes

- Tax systems can be classified as progressive, proportional or regressive

- Most countries have a mix of progressive (direct taxation) & regressive (indirect taxation) taxes in place

- Progressive tax system: as income rises, a larger percentage of income is paid in tax (e.g. UK Income Tax; UK Corporation Tax). This system is built around the idea of marginal tax rates

UK Progressive Tax Rates - June 2022

Tax Band Taxable Income Tax Rate Personal Allowance

Up to £12,500

0%

Basic Rate

£12,501 to £50,000

20%

Higher Rate

£50,001 to £150,000

40%

Additional Rate

Over £150,000

45%

Using this system, a salary of £60,000 would attract a tax bill of £11,499.80, calculated as follows:

First £12,500 - no tax

Next £37, 499 at 20% = £7499.80

Final £10,001 at 40% = £4,000 - Regressive tax system: as income rises, a smaller percentage of income is paid in tax (e.g. excise duties on alcohol & petrol in the UK; VAT; Air passenger duty). Regressive taxes can have a big impact on low-income households. In 2020 they represented 30% of income for the poorest 20% of households - but only 10% of income for the top 20% of households

- Proportional tax system: the percentage of income paid in tax is constant, no matter what the level of income e.g 10% tax is paid irrespective of whether income is £10,000 or £100,000. Bolivia uses this system & the tax rate is 13%

The Economic Effects of Changes in Tax Rates

- Changes in direct & indirect tax rates influence a range of economic variables

- The greater the size of the change, the greater the ripple effects through the economy

Effects Of Tax Rate Changes

| Impact | Explanation |

|

Incentive to work |

|

|

Tax revenues |

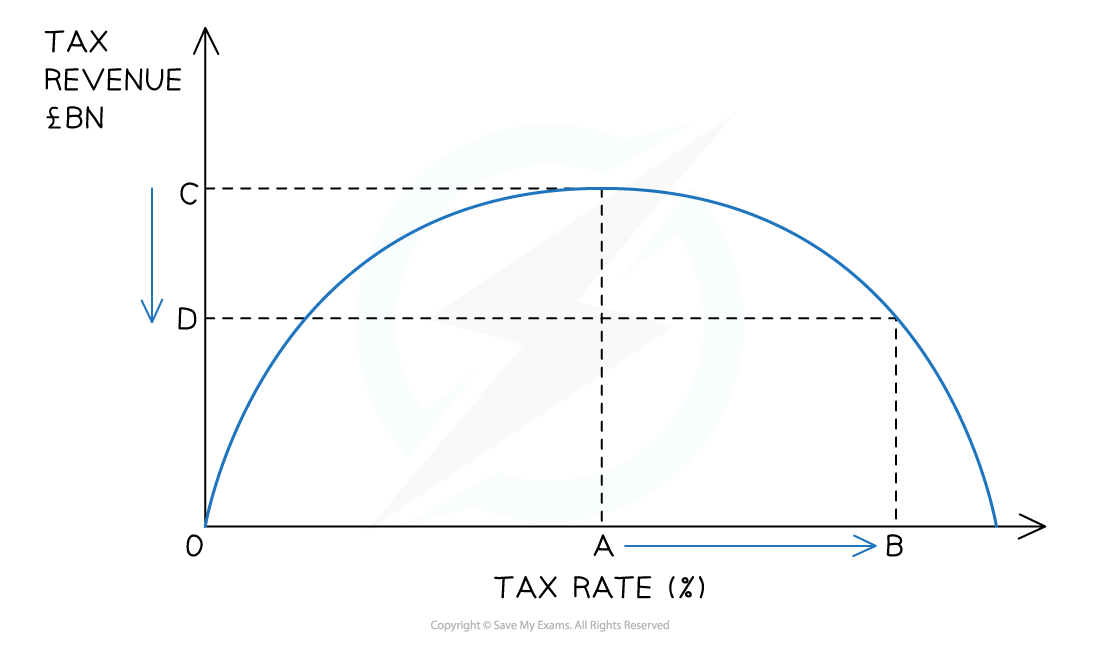

The Laffer Curve demonstrates the relationship between tax revenue & tax rates

|

|

Income distribution |

|

|

Real output & employment |

|

|

Average price level |

|

|

The trade balance (X-M) |

|

|

Flows of Foreign Direct Investment (FDI) |

|

转载自savemyexams

早鸟钜惠!翰林2025暑期班课上线

最新发布

© 2025. All Rights Reserved. 沪ICP备2023009024号-1