- 翰林提供学术活动、国际课程、科研项目一站式留学背景提升服务!

- 400 888 0080

2020年John Locke论文写作竞赛历史并列三等奖论文B全文

约翰洛克写作学术活动(John Locke)是由位于英国牛津的独立教育组织John Locke Institute与英国牛津大学和美国普林斯顿大学等名校教授合作组织的学术项目,意在考察学生在不同学科领域内的基本知识结构,议论文的基本写作格式与技巧,独立思考能力以及清晰的逻辑和辩证分析能力。以17世纪英国著名哲学家、古典自由主义鼻祖John Locke命名,是人文社科含金量最高的国际征文比赛之一。

John Locke写作比赛提供哲学、政治、经济学、历史、心理学、宗教、法律共七个领域的内容(仅限高中组,初中组题目是额外的),喜爱文科方向的学生绝对不要错过!

2022年6月30日 晚上11:59pm(GMT)

● 高年级组:15岁~18岁

● 低年级组:15岁及以下

Q1. Was there anything good about the British empire?

Q2. Is China an imperial power?

Q3. Is Western civilization in decline?

Q4. Do leaders make events or do events make leaders?

以下为2020年John Locke论文写作学术活动历史并列三等奖论文B,对经济学感兴趣的同学可以参考学习。

Is a strong state a prerequisite or an obstacle to economic growth?

Sungjin Park, Wellington College, United Kingdom

Joint Third Place for the 2020 History Prize | 8 min read

Introduction

There has been much ink spilt in favour of the limited government. Bodies of empirical work confirm the economic benefits of free markets and the robustness of such evidence seems hard to deny: markets deliver economic growth and governments make plenty of mistakes. [1] [2] A cursory glance at such evidence may lead to the presumption that strong states hinder economic growth. That is, if markets and private transactions are the engines for economic growth, strong states may seem a mere obstruction. However, this laissez-faire line of thought overlooks the state’s role in providing the very background for such growth-conducive arrangements.

Indeed, much of recent empirical and theoretical work has been devoted to buttressing the exact opposite intuition. In work-related to the economic development of weak states in Africa, for instance, the factor crucial to the failure of economic development of African states has been identified as the state’s lack of capacity rather than an overwhelming projection of state power. [3] [4] More significantly, the main lessons learned from Acemoglu and Robinson’s seminal work in historical institutionalism show that growth requires an agglomeration of institutional factors that incentivize agents to behave in ways that are conducive to economic growth. [5]

Now, the aforementioned confusion arises because of a mistaken understanding of what ‘prerequisite’ means in this context. A strong state being a prerequisite for economic growth does not mean that a strong state is a sufficient condition for economic growth. This understanding of ‘prerequisite’ would make the question overly tendentious in favour of the ‘obstacle’ view. There are simply too many strong states that fail at delivering economic growth. For instance, in Venezuela’s case, widespread nationalisation scared foreign investors and inefficiencies in state-owned firms severely hindered economic performance. We may say without qualm that Venezuela was and is a strong state, albeit one in which the strong state acts as an obstacle to growth.

Thus, a proper understanding of ‘prerequisite’ should be that a strong state is a necessary condition for economic growth. That is, wherever there is economic growth, there is a strong state that undergirds that growth, while it is possible to have a strong state that does not deliver economic growth. I will argue that a strong state is a prerequisite for economic growth. I will argue that a strong state enables sociopolitical stability, which acts as the minimal institutional preconditions on which incentives for growth are guaranteed.

In defining state strength, I will stay neutral by following Acemoglu in measuring state strength as having two dimensions along state capacity: economic and political.[6] A state can be strong economically, in which case it has the capacity to utilize and direct resources throughout its territory. (i.e. through taxation and spending) If a state is politically strong, then rulers are not easily replaceable whereas the opposite is true for weak states. These definitions of state strength leave it open whether strong states are prerequisites or obstacles to economic growth because they measure the underlying capacity of states, which can manifest in ways that are conducive or opposed to economic growth.

Political Weakness, Unpredictability and Underinvestment

Political instability is defined as the propensity of a change in the executive, either by “constitutional” or “unconstitutional” means.[7] When there is political instability, social instability, measured by incidence of revolution, frequency in change of power and likelihood of war become much more likely.[8] In the absence of a politically strong state that guarantees such social stability, the following problem for economic growth arises.

First, institutional predictability is threatened, which significantly reduces consumer and investor confidence. A lack of consistent policies augmented by the likelihood of expropriation by various actors facilitates capital outflows. This is because investors’ propensity to invest depends on the knowledge that financial institutions will generate returns on savings and investments in the long-run; politically weak states fail to guarantee this due to the risk of unrest.[9] Moreover, inconsistent expropriation creates uncertainty for firms and makes the state a less attractive place to invest. Under these conditions, households are also disincentivized from saving with financial institutions, which are perceived to be insecure. The net effect is a decrease in the overall capital stock and significantly lower economic growth than in the counterfactual.

Second, continuity in infrastructural investments is threatened. Under conditions of political weakness, the state does not have sustainable infrastructure strategies because of persistent changes to policy priorities and a lack of transparency in infrastructure projects’ procurement.[10] This means that firms have little incentive to cooperate and invest and mechanisms such as public-private partnerships (PPPs) are likely to fail to be efficient.[11] Thus, for instance, politically weak states such as the Democratic Republic of the Congo, suffer from chronic supply-chain disruption due to seasonal flooding and inadequate road networks. [12] [13] This represents a large obstacle to growth because crucial infrastructure such as transport infrastructure minimizes downtime and delays and allows for smooth supply chains, allowing industries to be consistently more productive.

This trend of political weakness of states further exacerbates economic weakness of states by laying ground for states’ inability to facilitate investments in high value-add industries. For instance, much of the literature on the resource curse attributes many resource-rich African states’ dependence on low-value and volatile raw materials to be based on just such a lack of state capacity to set up crucial infrastructure. [14] This is consistent with the observation that most weak African states have mainly been exporters of lightly processed or unprocessed natural resources which, when processed, increase in value by up to 400 times that of the original commodity.[15]

Instability, Clientelism and Waste

Political weakness also generates systematic incentives for wastefulness which saps economic growth potential. Socio-political instability owing to the political weakness of states means higher stakes for incumbent regimes and reliance of client-patron networks in regions where state power does not penetrate.[16] That is because there are divergent levels of penetration in state power, incumbent regimes require cooperation from regional players and survive by private goods provisions to their small winning coalitions instead of public goods provisions for the wider public.[17]

These clientelist networks are detrimental to economic growth in at least the following two ways. First, client networks often foster a culture of corruption in which regional players are able to run graft schemes through which much of the resources devoted to those projects are divided up for private gain.[18] Especially because clientelist networks often operate on the basis of guaranteed employment, “underinvestment stems from the need to keep offers of employment credible in order to increase the probability of re-election”.[19] As a net effect, clientelism creates a feedback loop which prevents businesses from being established, hindering economic growth and limiting tax revenue to already weak states, trapping them in a cycle of under-investment.[20]

Second, clientelist networks that stem from the weakness of states lead to wastefulness in public investments. Because weak governments need to consistently invest in the same actors that make up the winning coalition, redundant infrastructure investments happen. For instance, construction of the Kenyan standard gauge railway project was conducted at highly inflated prices, with land confiscation and unfair compensation, local procurement and employment benefiting regions affiliated with the ruling party.[21]

Strong States and Stability

In strong states, such crucial stability is preserved, allowing the state to generate institutional setups that are conducive to growth. In recent history, strong states have mainly existed in two different forms: authoritarian strong states and OECD-type democratic nations, which Acemoglu refers to as “consensually strong states.”[22]

In consensually strong states, there is a state-society consensus; firms and households trust the government and state actors opt to provide public goods to the taxpayers rather than expropriate for private gain.[23] This firstly allows firms and households to invest and save with relative long-term certainty, which generates higher returns on capital. Further, democratically strong states’ capacity to collect taxes permit government investment in infrastructure, legislature and the judiciary which ground the operation of markets. Finally, strong institutions shape the decisions made by the ruler, acting as a check on arbitrary decision making and preventing catastrophic decisions which could lead to economic ruin.[24] Given appropriate operation, this democratic stability creates a stable base for business activity, investor and consumer confidence, and thus sustained economic growth.

In contrast, authoritarian strong states are generally more interventionist, and exert more control over their markets: there are usually no fully functioning check-and-balance systems in place. This can drive economic growth or, if the strength is misapplied, can cause the strong authoritarian state to become an obstacle. For instance, strong authoritarian states’ ability to intervene in the private sector can lead to certain groups being favoured in return for support, which can reduce market efficiency, or leaders pursuing policies aimed at consolidating power and lining allies’ pockets rather than enriching the country. Strong authoritarian states’ ability to rewrite laws to their benefit makes private-state contracts insecure, reducing trust and business confidence, and misapplication of power can cause them to “become predators of private sector wealth”.[25]

History provides numerous examples of strong authoritarian states which hampered economic growth in these ways. In Hussain’s Iraq, frequent, arbitrary interventions in the market made the Iraqi economy highly unpredictable, leading to chronic problems in savings and investments.[26] Likewise, the USSR suffered due to government intervention and the development of a command economy with price floors and ceilings. This created inefficiencies and market collapses, which led to further controls, further inefficiencies, and further economic woes.[27]

On the other hand, a strong authoritarian state pursuing growth-oriented policies can act as a robust engine for economic growth. The so-called Asian Tigers - Taiwan, Singapore, Hong Kong, and South Korea - were all, to large extents, strong authoritarian states during periods of rapid economic growth. All four Tigers saw state-led investment in education, combined with government financing which created low-interest corporate loans to fuel business growth and ultimately the policies were carefully fostered economic incentives, rather than arbitrary interventions.[28]

An instructive example is found in the industrial strategy of Park Chung-hee’s military regime in South Korea, which saw exponential growth since the 1960s. The strategy was to direct massive state-led investments in high-value-add infrastructures and industries. For example, the 1973 National Investment Fund Act allowed funds collected from state bond issuance to be lent out at low-interest rates to companies engaged in heavy industry and chemical sectors. Policies such as these introduced long-term certainties in the financial system at a time when investment destinations were generally unpromising by ‘picking’ winners in conglomerates such as Samsung, Hyundai and LG. This contributed to a sustained increase in savings and investments.[29]

These targeted interventions, such as the demand that major companies deliver certain levels of production and profitability in return for government support, allowed private actors to pursue profits but, crucially, left them with the freedom to choose the means to that end.[30] These policies also aligned the interests of the government and conglomerates, encouraging cooperation for large infrastructure projects such as the Gyeongbu Highway and investments in state-led enterprise projects such as the Pohang Iron & Steel Company. Growing tax revenues also aided further investments in further large-scale infrastructure projects. [31] [32]

Conclusion

Alexander Hamilton once wrote “the state ought to excite the confidence of capitalists, who are ever cautious and sagacious, by aiding them to overcome the obstacles that lie in the way of all experiments,”[33] and these words are consonant with my findings. Strong states are required as a

minimal background for economic growth.

However, that doesn’t mean that strong states are a panacea. While strong democratic states which minimize market intervention are generally able to sustain moderate economic growth, strong authoritarian states show a much wider range of outcomes. Misdirected and arbitrary institutions can create obstacles to economic growth and even catastrophic outcomes. On the other hand, careful interventions and management of industry can create the type of growth seen in the ‘Asian Tigers’ economies.

I conclude that although a strong state is a prerequisite for economic growth, the extent to which this strong state acts as an obstacle or an enabler depends on policies, markets and institutions.

Footnotes

1 David Woodward, Debt, Adjustment and Poverty in Developing Countries: National and International Dimensions of Debt and Adjustment in Developing Countries (London, New York: Pinter Publishers in association with Save the Children, 1992)

2 Milton Friedman, An Economist’s Protest (Thomas Horton & Daughters, 1975)

3 Robert H. Bates, Prosperity & Violence: The Political Economy of Development (New York: W. W. Norton & Company, 2009)

4 Charles Tilly, Coercion, Capital, and European States, AD 990–1992 (Cambridge: Blackwell, 1990)

5 Daron Acemoglu and James A. Robinson. 2012. Why Nations Fail: The Origins of Power, Prosperity, and Poverty (New York: Crown Business, 2012).

6 Daron Acemoglu, Politics and Economics in Weak and Strong States, Journal of Monetary Economics 52, (2005): 1199–1226

7 Alberto Alesina, Sule Özler, Nouriel Roubini, and Phillip Swagel, Political Instability and Economic Growth, Journal of Economic Growth 1, no. 2 (June 1996): 189-212

8 Samuel P. Huntington, Political Order in Changing Societies (New Haven: Yale University Press, 1968)

9 Ari Aisen and Francisco Jose Veiga, “How Does Political Instability Affect Growth?” IMF Working Paper, January 2011.

10 WBG PPP CCSA, GGP, COST, and PPIAF, Disclosure in Public Private Partnerships: Jurisdictional Studies, August 2015, 7.

11 ibid.

12 IBP USA, Congo Democratic Republic Country Study Guide Volume 1 Strategic Information and Developments (Washington D.C.: IBP USA, 2012)

13 Atsushi Immi, Effects of Improving Infrastructure Quality on Business Costs: Evidence from Firm-Level Data in Eastern Europe and Central Asia, The Developing Economics 49, no. 2 (June 2011): 121-147

14 Michael Lewin, ‘Botswana’s Success: Good Governance, Good Policies, and Good Luck,’ in Chuhan-Pole, P., et al. (eds.), African Success Stories, World Bank Group, 2011.

15 “Information Brief: Enhancing Natural Resource Governance in Africa,” International Institute for Democracy and Electoral Assistance, 2017

16 Bueno de Mesquita, James D. Morrow, Randolph M. Siverson, and Alastair Smith, Logic of Political Survival (Massachusetts: MIT Press, 2003)

17 Wouter Veenendaal and Jack Corbett, Clientelism in Small States: How Smallness Influences Patron–Client Networks in the Caribbean and the Pacific, Democratization 27, no. 1 (2020): 61-80, DOI:10.1080/13510347.2019.1631806

18 Jean-Louis Briquet, "Clientelism," Encyclopædia Britannica, December 29, 2015, accessed July 15, 2020, h ttps://www.britannica.com/topic/clientelism

19 James A. Robinson and Thierry Verdier, The Political Economy of Clientelism, The Scandinavian Journal of Economics 115, no. 2 (2013): 260-291

20 3. African Development Bank, “Africa’s Infrastructure: Great Potential but Little Impact on Inclusive Growth” in African Economic Outlook 2018, 2018, 63-94.

21 Yuan Wang and Uwe Wissenbach, Clientelism at Work? A Case Study of Kenyan Standard Gauge Railway Project, Economic History of Developing Regions 34, no. 3 (2019): 280-299, DOI:

1 0.1080/20780389.2019.1678026

22Acemoglu, Politics and Economics in Weak and Strong States.

23 ibid.

24 Hilton L. Groot, Do Strong Governments Produce Strong Economies? The Independent Review 5, no. 4 (Spring 2001): 565-573

25 ibid.

26 Abbas S. Mehdi, "The Iraqi Economy under Saddam Hussein: Development or Decline," Middle East Policy 4, no. 1-2 (1995): 242+. Gale Academic OneFile (accessed July 15, 2020).

27 Michael Ray, "Why Did the Soviet Union Collapse," Encyclopædia Britannica, accessed July 15, 2020, h ttps://www.britannica.com/story/why-did-the-soviet-union-collapse

28 Groot.

29 OECD (2020), Saving rate (indicator). doi: 10.1787/ff2e64d4-en (Accessed on 16 July 2020), https://data.oecd.org/natincome/saving-rate.htm

30 Tae-gyun Park, The 8·3 Measure and Industrial Rationalization Policy: Economic Foundation of the Yushin System, 역사와 현실, no. 88 (2013): 101-144

31 최광승, 박정희는 어떻게 경부고속도로를 건설하였는가, 한국학(구 정신문화연구) 33, no. 4, (2010): 175-202

32 POSCO, “History of POSCO: 1967~1970 Foundation of POSCO,” Accessed July 15, 2020, h ttp://www.posco.co.kr/homepage/docs/eng6/jsp/company/posco/s91a1000012c.jsp

33 Chalmers Johnson, The Industrial Policy Debate (San Francisco: ICS Press, 1984),17.

Bibliography

Daron Acemoglu, Politics and Economics in Weak and Strong States, Journal of Monetary Economics 52, (2005): 1199–1226

Daron Acemoglu and James A. Robinson. 2012. Why Nations Fail: The Origins of Power, Prosperity, and Poverty (New York: Crown Business, 2012).

3. African Development Bank, “Africa’s Infrastructure: Great Potential but Little Impact on Inclusive Growth” in African Economic Outlook 2018, 2018, 63-94.

Ari Aisen and Francisco Jose Veiga, “How Does Political Instability Affect Growth?” IMF Working Paper, January 2011.

Alberto Alesina, Sule Özler, Nouriel Roubini, and Phillip Swagel, Political Instability and Economic

Growth, Journal of Economic Growth 1, no. 2 (June 1996): 189-212

Robert H. Bates, Prosperity & Violence: The Political Economy of Development (New York: W. W. Norton & Company, 2009)

Milton Friedman, An Economist’s Protest (Thomas Horton & Daughters, 1975)

Hilton L. Groot, Do Strong Governments Produce Strong Economies? The Independent Review 5, no.4 (Spring 2001): 565-573

Samuel P. Huntington, Political Order in Changing Societies (New Haven: Yale University Press, 1968)

IBP USA, Congo Democratic Republic Country Study Guide Volume 1 Strategic Information and Developments (Washington D.C.: IBP USA, 2012)

Atsushi Immi, Effects of Improving Infrastructure Quality on Business Costs: Evidence from

Firm-Level Data in Eastern Europe and Central Asia, The Developing Economics 49, no. 2 (June 2011): 121-147

“Information Brief: Enhancing Natural Resource Governance in Africa,” International Institute for Democracy and Electoral Assistance, 2017

Chalmers Johnson, The Industrial Policy Debate (San Francisco: ICS Press, 1984),17.

Michael Lewin, ‘Botswana’s Success: Good Governance, Good Policies, and Good Luck,’ in Chuhan-Pole, P., et al. (eds.), African Success Stories, World Bank Group, 2011.

Jean-Louis Briquet, "Clientelism," Encyclopædia Britannica, December 29, 2015, accessed July 15, 2020, https://www.britannica.com/topic/clientelism

Abbas S. Mehdi, "The Iraqi Economy under Saddam Hussein: Development or Decline," Middle East Policy 4, no. 1-2 (1995): 242+. Gale Academic OneFile (accessed July 15, 2020).

Bueno de Mesquita, James D. Morrow, Randolph M. Siverson, and Alastair Smith, Logic of Political Survival (Massachusetts: MIT Press, 2003)

OECD (2020), Saving rate (indicator). doi: 10.1787/ff2e64d4-en (Accessed on 16 July 2020), https://data.oecd.org/natincome/saving-rate.htm

Tae-gyun Park, The 8·3 Measure and Industrial Rationalization Policy: Economic Foundation of the Yushin System, 역사와 현실, no. 88 (2013): 101-144

POSCO, “History of POSCO: 1967~1970 Foundation of POSCO,” Accessed July 15, 2020, http://www.posco.co.kr/homepage/docs/eng6/jsp/company/posco/s91a1000012c.jsp

Michael Ray, "Why Did the Soviet Union Collapse," Encyclopædia Britannica, accessed July 15, 2020, h ttps://www.britannica.com/story/why-did-the-soviet-union-collapse

James A. Robinson and Thierry Verdier, The Political Economy of Clientelism, The Scandinavian Journal of Economics 115, no. 2 (2013): 260-291

Charles Tilly, Coercion, Capital, and European States, AD 990–1992 (Cambridge: Blackwell, 1990)

Wouter Veenendaal and Jack Corbett, Clientelism in Small States: How Smallness Influences Patron–Client Networks in the Caribbean and the Pacific, Democratization 27, no. 1 (2020): 61-80, DOI: 10.1080/13510347.2019.1631806

Yuan Wang and Uwe Wissenbach, Clientelism at Work? A Case Study of Kenyan Standard Gauge Railway Project, Economic History of Developing Regions 34, no. 3 (2019): 280-299, DOI: 1 0.1080/20780389.2019.1678026

WBG PPP CCSA, GGP, COST, and PPIAF, Disclosure in Public Private Partnerships: Jurisdictional Studies, August 2015, 7.

David Woodward, Debt, Adjustment and Poverty in Developing Countries: National and International Dimensions of Debt and Adjustment in Developing Countries (London, New York: Pinter Publishers in association with Save the Children, 1992)

최광승, 박정희는 어떻게 경부고속도로를 건설하였는가, 한국학(구 정신문화연구) 33, no. 4, (2010): 175-202

2022年John Locke论文学术活动已经放题啦!

对其他学科领域感兴趣的同学

可扫码添加微信咨询

免费领取历年相关获奖论文学习

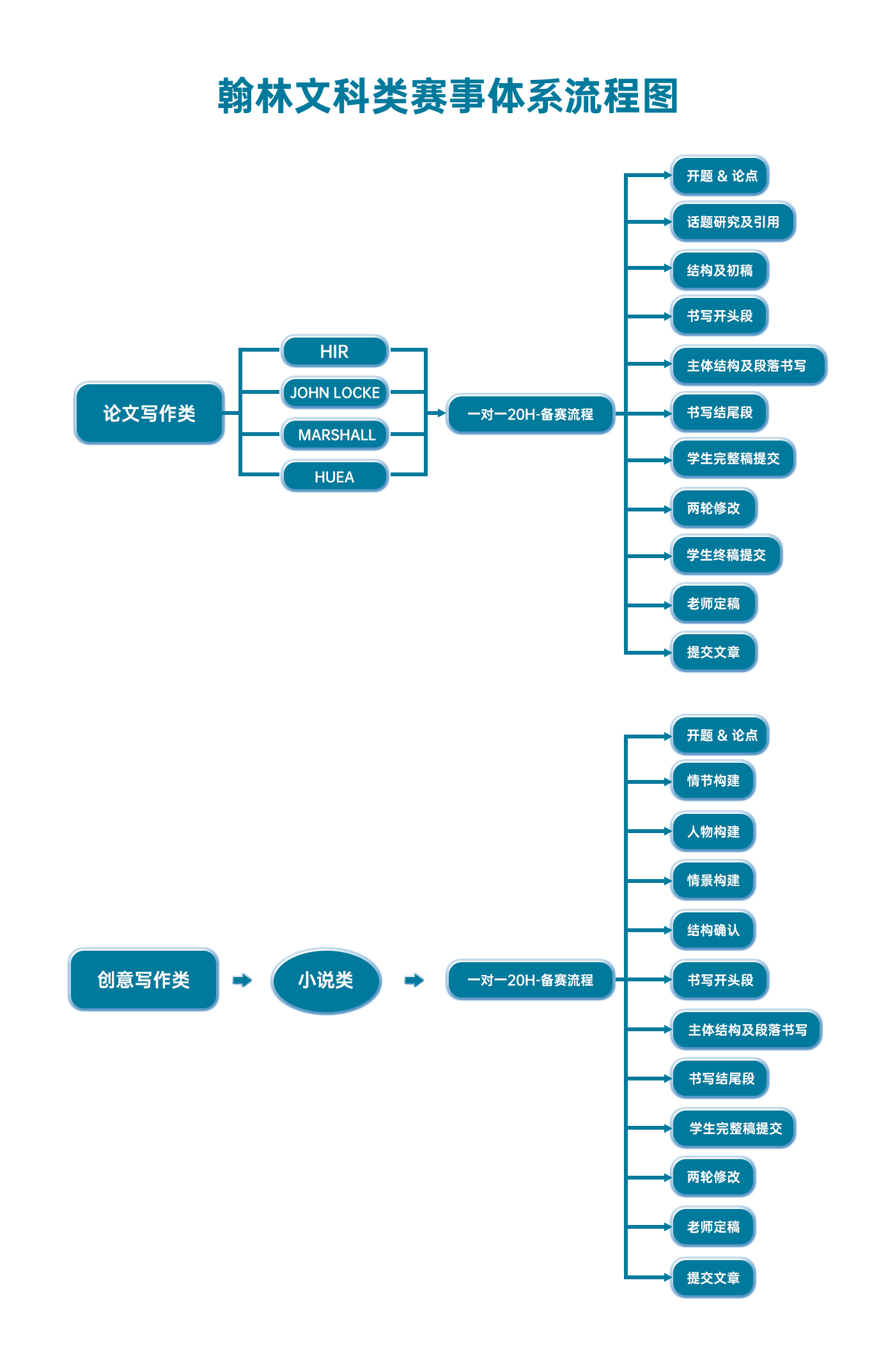

翰林文科学术活动课程体系流程图

最新发布

© 2026. All Rights Reserved. 沪ICP备2023009024号-1