- 翰林提供学术活动、国际课程、科研项目一站式留学背景提升服务!

- 400 888 0080

2020年John Locke论文写作竞赛经济学二等奖论文全文

约翰洛克写作学术活动(John Locke)是由位于英国牛津的独立教育组织John Locke Institute与英国牛津大学和美国普林斯顿大学等名校教授合作组织的学术项目,意在考察学生在不同学科领域内的基本知识结构,议论文的基本写作格式与技巧,独立思考能力以及清晰的逻辑和辩证分析能力。以17世纪英国著名哲学家、古典自由主义鼻祖John Locke命名,是人文社科含金量最高的国际征文比赛之一。

约翰洛克写作学术活动(John Locke)是由位于英国牛津的独立教育组织John Locke Institute与英国牛津大学和美国普林斯顿大学等名校教授合作组织的学术项目,意在考察学生在不同学科领域内的基本知识结构,议论文的基本写作格式与技巧,独立思考能力以及清晰的逻辑和辩证分析能力。以17世纪英国著名哲学家、古典自由主义鼻祖John Locke命名,是人文社科含金量最高的国际征文比赛之一。

John Locke写作比赛提供哲学、政治、经济学、历史、心理学、宗教、法律共七个领域的内容(仅限高中组,初中组题目是额外的),喜爱文科方向的学生绝对不要错过!

学术活动要求:每篇文章只能在所选主题类别中回答一个问题,可以提交多篇文章,但不得超过2000字(不包括图表、数据表、脚注、参考书目或作者声明)。

截止投稿时间:

2022年6月30日 晚上11:59pm(GMT)适合学生:

● 高年级组:15岁~18岁

● 低年级组:15岁及以下

Q1. Is Bitcoin a blessing or a curse?

Q2. What’s wrong with the housing market? How can we fix it?

Q3. Should Amazon pay people more? What would happen if they immediately increased every worker’s salary by twenty percent?

Q4. Is Henry George’s land value tax fair, efficient, both, or neither?

What are the most important economic effects - good and bad - of forced redistribution? How should this inform government policy? Saskia Poulter, The Tiffin Girls' School, United Kingdom Second place runner up of the 2020 Economics Prize | 8 min read

From its genesis, the metanarrative of the coronavirus crisis has been the exacerbation of existing inequalities: all are in the same storm, but by no means the same boat. The US Bureau of Labour Statistics estimates that an employee in the bottom 20% of the income distribution was four times more likely to lose their job in April 2020 than their counterpart in the highest fifth, whose average propensity to save in fact rose due to foregone expenditure.[1] Meanwhile, the Schumpeterian forces of creative destruction have intensified under market uncertainty such that, epitomising current trends towards tech monopolisation and platform capitalism,[2] Jeff Bezos is projected to become the world’s first trillionaire by 2026.[3] These recent tendencies, however, situate themselves within a wider current: since Piketty famously hypothesised that r>g,[4] Marx’s designation of capital concentration as one of the ‘immanent laws of capitalist production’ has gained renewed authority.[5] Judging, therefore, that government intervention is necessary to forestall such inertia, this essay will seek to establish the primacy of increasing equality: the most important economic effect of forced redistribution. It will weigh this against the potential for undermined efficiency through the lenses of income, inheritance and Tobin taxation, before considering the limitations of consequentialist analysis in informing government policy.

Most fundamentally, the Anglo-American status quo constitutes a socially inefficient resource distribution. Assuming the diminishing marginal utility of wealth, a Bergson-Samuelson-SWF can be constructed, from which convex social indifference curves are derived; when compared to a social utility distribution frontier, these determine a maximum which exhibits only moderate inequality.[6] By suggesting that in excess of a critical value happiness and wealth show negligible correlation, the Easterlin Paradox corroborates this conclusion. Meanwhile, United Nations analysis that the top decile of the American population appropriated 91% of income growth between 1989 and 2006 renders the traditional supposition that inequality benefits all absolutely by ‘trickling down’ woefully unconvincing.[7]

Moreover, Wilkinson and Pickett suggest that inequality generates acute psychic costs (see Figure 1).[8] In their 2018 book ‘The Inner Level’, ‘status anxiety’- that is, the fear of being perceived as unsuccessful by one’s materialistic society- is posited as a evolutionarily grounded causal mechanism for this: in humans as in other primates, cortisol levels are elevated in response to precarity in social dominance hierarchies.[9] Consider the instability inherent to neoliberalism as defined by Foucault (‘the extension of competition to all aspects of life’),[10] and the recent explosion of both pre- and post-transfer variance in individual incomes over time,11 and Wilkinson and Pickett’s claims gain greater credence.

The literature on inequality often delineates between equality of opportunity and outcome; whilst careful not to deny that some income differential is a desideratum for both static and dynamic efficiency, however, Stiglitz regards this distinction as a false dichotomy.[12] Since the Scottish Enlightenment, economists have recognised inequality’s function in incentivising investment, innovation and risk-taking; often, however, children from low-income families lack access to the education, healthcare and financial opportunities which would enable them to respond to such incentives. Equity aside, these barriers imply a gross opportunity cost in the underdevelopment of human capital, leaving workers with low functional flexibility and occupational mobility. Given Deloitte’s estimate that in the burgeoning digital age the half-life of a learned skill is only 4.5 years- compared to 26 years in the previous generation- such immobility is surely troubling.[13]

Moreover, contrary to Kaldor’s purported trade-off between efficiency and equality, the notion that a high Gini coefficient undermines growth is now settling into academic orthodoxy.[14] One explanation for this draws on Keynesian theory of consumption: since low-income agents have a higher marginal propensity to consume, low discretionary incomes among them result in high unconsummated demand. Another justification suggests that popular cries for trade protectionism can be attributed to financial vulnerability: Anglo-American workers resist efficiency-enhancing restructuring to a greater degree than mainland Europeans partially because the stakes of job loss are for them much higher. A robust social safety net might also minimise risk-aversion among entrepreneurs by acting as a guarantee; this parallels the logic underlying England’s Section 93 and America’s Chapter II bankruptcy laws.[15] Even if one rejects all of the above analysis, however, the fact that the liberal-residual US grew at 1.8% p.a. in 1990-2008, compared to the 2.6% of social democratic Norway, demonstrates that equality is at least not inimical to efficiency.[16]

Finally, there is growing suspicion that the psychosocial instability Wilkinson and Pickett describe is paralleled in the financial sector: Rajan posits an inequality-credit-crisis nexus, noting that ‘easy credit has been used as a palliative by governments throughout history’ to maintain aggregate demand and mitigate consumption inequality despite stagnating incomes.[17] Supposedly, this effect contributed to the overleveraging which was so catastrophic around the Minsky moment of 2008. It is clear that, because crises are costly, redistribution acting as a prophylactic to indebtedness is preferable to ex-post instruments such as resolution.

It would be reasonable to conclude, therefore, that a more equal income distribution is, ceteris paribus, a desirable objective. Indubitably, however, the cp assumption is prohibitively reductive- the ways in which this is the case being contingent on the policy instrument deployed. Consider three examples:

A standard concern is that progressive income taxation generates efficiency costs which negate any distributional benefits.[18] Firstly, taxation disincentivises labouring as implies lower net wages, hence a lower opportunity cost of leisure. ‘Top talent emigration’ and higher turnover rates might ensue and, according to efficiency wage theory, agents reduce the effort allocated to their work. Tax evasion/avoidance is a further contributing factor, as is compensation bargaining, whereby top earners are assumed capable of negotiating their wages upwards, the incentives for which are greatest when tax rates are low. Accordingly, it is argued, top tax-rate cuts stimulate rent-seeking, though not necessarily economic growth.[19]

In identifying a rate above which these effects amount to net detriment, the elasticity of taxable income is a useful parameter. Ultimately, whilst there is no consensus as to its magnitude (Gruber and Saez calculate the current value to be 0.4, but estimates range between zero and one),[20] the precise figure will surely be contingent on the elimination of legal loopholes and poverty traps. The latter is a familiar problem in the UK, where 2017 Universal Credit proposals left families £1144 worse off p.a. where a second earner took five additional weekly hours of minimum-waged work.[21] Governments must be careful to avoid engineering such ‘traps’.

The optimal magnitude of transfers, meanwhile, should be determined according to Dalton’s Principle of Maximum Social Advantage, with the marginal social benefit of spending equalling the marginal social cost.[22] This calculation should incorporate inflation, fiscal sustainability and opportunity costs: particularly, whether capital expenditure might, by addressing inequality’s drivers, be a more effective long-term measure.[23] Concerns that transfers encourage freeriding and a ‘dependency culture’ should be considered but not overemphasised: having repeatedly failed to withstand empirical scrutiny, their presentation often resembles the moralising rhetoric of Weberian stratification.[24]

Nevertheless, income taxation overlooks the fact that income Gini coefficients are on average half the size of those for wealth; inheritance taxation seems an intuitive method of redressing this imbalance.[25] Surprisingly, however, Wolff questions whether such intuition is misguided, hypothesising that bequests in fact decrease inequalities of wealth since transfers are usually greater as a proportion of the current holdings of poorer households compared to richer ones.[26] Ultimately, though, longer-term dynamics undermine this suggestion: poorer agents usually spend their gains whereas the rich are able to save them. It has also been argued that inheritance taxes increase capital scarcity, hence capital returns, thereby exacerbating inequality overall.[27] Empirical analysis provides some foundation for this claim, though it remains unlikely to be sufficient in magnitude for redistribution to be counterproductive overall.[28]

As with income taxation, considerations of elasticity also apply to inheritance, with the additional possibility that high rates could incentivise the profligate running down of savings. Nonetheless, when combined with the ethical argument that inherited wealth is currently allocated arbitrarily (according to the ‘birth lottery’), the case for higher levies appears strong: today, only 5% of UK estates are subject to inheritance tax.[29]

Finally, a Tobin tax is a small ad valorem tax on financial transactions, the burden of which falls overwhelmingly on the most affluent as owners of capital.[30] Though the levy would universally increase transaction costs, currency speculation is virtually the only exchange which occurs at a sufficient frequency for a charge so small to factor in the trader’s cost-benefit analysis; accordingly, the European Parliament estimates that a rate of 0.1% would raise $50bn in annual revenue whilst having virtually no distortionary effect on the real economy.[31]

If imposed unilaterally, however, rigid controls might render a country uncompetitive; this would prove particularly detrimental to the UK, where financial services comprise 6.9% of total economic output.[32] One solution to the collective action problem of opt-out jurisdiction freeriding could be to require the tax’s implementation as a condition of access to supranational organisations such as the IMF; whether governments are politically prepared to so dramatically renounce fiscal sovereignty, however, is another matter.[33]

Moreover, critics of the Tobin tax describe its potential to reduce market liquidity, resulting in falling investment and rising costs of capital. They argue that financial transactions are often enacted to hedge risk and that by discouraging this the policy could prove destabilising. Ultimately, however, such negative effects are offset against the fact that slowing capital flows reduces exchange- rate volatility, leaving national networks less vulnerable to exogenous shocks. Irrational exuberance- led speculative pressures on exchange rates have been known to result in interest rates higher than is warranted by internal monetary conditions, damaging growth and employment; the Asian, Latin American and Russian crises of the 1990s have each been attributed in large part to destabilising capital flows.[34] If implemented multilaterally, then, a Tobin tax could be an efficient mode of collecting funds to be redistributed both domestically and internationally.

Notwithstanding, political economy poses a significant limitation on the influence of consequentialist analysis on policy prescription. Applying Downsian median voter theory, the Meltzer- Richard model suggests that the politico-economic equilibrium should rest in favour of redistributive policy, assuming a right-skewed income distribution and perfectly rational population.[35] Larcinese notes that such abstractions are rarely supported by empirical observation, however, as voter turnout is positively correlated with income, meaning that the pivotal voter is in fact richer than the median in the income distribution.[36] Moreover, the assumption of a perfectly rational homo economicus is obviously simplistic: widespread information asymmetries have been exposed, for example, by studies showing that voters underestimate the extent of inequality in their societies, and even then would prefer a more egalitarian society to that in which they believe they live.[37] Voters also weigh factors other than private pecuniary benefit when assessing policy, as illustrated by enduring popular interest in figures such as Nozick and Rawls.

We should also note that current high levels of public dependence on transfers might well persist into the medium term, given both the shocks and long-term tendencies described above. Beside the radical restructuring global lockdowns have ushered, a long-anticipated wave of automation is projected to reduce a significant proportion of the middle class to technological unemployment;[38] Moravec’s paradox states that high-level reasoning requires less computational power than tasks demanding agile mobility, meaning that ‘high-skilled’ jobs such as accounting are particularly vulnerable.[39] Thus, one might anticipate an increase in self-interested public support for redistribution.

In final analysis, then, governments must be careful to avoid inducing the ill-effects that poorly engineered policy can create; chief among these stand poverty traps, declining international competitiveness and loophole exploitation. Moreover, redistribution must not be viewed as a panacea for socioeconomic ills: transfers leave embodied cultural capital largely untouched, for example, and redressing this would require a much wider package of supply-side interventions.[40] Nevertheless, an extensive body of evidence suggests that citizens in general prefer greater redistribution to the status quo, that these preferences are underrepresented in electoral data, and that increasing numbers will depend upon state assistance for at least the foreseeable future. Consider also the benefits of greater growth, aggregate utility and financial stability which arise from moderate equality, and a strong case can be made that redistribution is indeed a necessary instrument for counterbalancing Marx’s doctrine of increasing misery.[41]

Author's Note

Whilst questions of international redistribution (aid and reparations, for example) undoubtedly warrant discussion, for the sake of brevity this essay focuses on redistribution within a single jurisdiction. For the same reason, it discusses redistribution among citizens as opposed to between firms; the role of subsidies and corporation tax, for example, fall outside of its remit. I presuppose a relatively high-income country, drawing most empirical data from the UK and US.

Footnotes

1 Larry Elliott, ‘Unemployment due to Covid-19 is surely worth more than a footnote’, The Guardian, 10 May 2020.

2 Nick Srnicek, Platform Capitalism (Cambridge: Polity Press, 2016).

3 Leaders, ‘Big tech is thriving in the midst of the recession’, The Economist, 2 May 2020. Tech monopolies Microsoft, Apple, Alphabet, Amazon and Facebook now comprise more than one-fifth of the entire value of the S&P 500 stock market index. 4 Thomas Piketty, Capital in the Twenty-First Century (Cambridge: Harvard University Press, 2014). Here, r denotes the rate of return on capital (i.e. profits, dividends, rents, incomes and interest), whilst g denotes the overall rate of economic growth. 5 Karl Marx, Capital: a Critique of Political Economy v.1 (London: Penguin Classics, 1990).

6 Nicola Acocella, The Foundations of Economic Policy (Cambridge: Cambridge University Press, 2000).

7 Jan Vandermoortele, ‘Inequality and Gresham’s Law: the bad drives out the good’, Unpublished thinkpiece for the UN in China, March 2013. <https://wess.un.org/archive/2015/wp-content/uploads/2015/02/dps_paper_vandemoortele.pdf>

8 Table: Karen Rowlingson, Does Income Inequality Cause Health and Social Problems? (York: Joseph Rowntree Foundation, 2011). <https://www.jrf.org.uk/sites/default/files/jrf/migrated/files/inequality-income-social-problems-full.pdf> In doing so, they address the objection that absolute as opposed to relative poverty is the only factor to warrant consideration.

9 Richard Wilkinson and Kate Pickett, The Inner Level (London: Penguin Books, 2018).

10 Michel Foucault, The Birth of Biopolitics: Lectures at the College de France, 1978-1979 (London: Palgrave Macmillan, 2008).

11 Jacob Hacker, The Great Risk Shift (Oxford: Oxford University Press, 2008). Hacker notes that locus of control scores- a powerful predictor for anxiety- have become substantially more external in recent years. He credits this to the lack of a robust social safety net.

12 Joseph Stiglitz, The Price of Inequality (London: Penguin, 2013). In his book, he formalises the negative correlation between income inequality and the intergenerational mobility of wealth as ‘The Great Gatsby Curve’, which manifests tangibly as the fact that an American child whose parents fall within in the bottom decile of the income distribution has a 20% chance of reaching college, whilst for those from the top decile that figure is closer to 90%.

13 Indranil Roy, Future of Work: an Introduction, January 2019

<https://www2.deloitte.com/content/dam/Deloitte/it/Documents/human-capital/Future%20of%20Work_Deloitte.pdf> [Last accessed: 9 June 2020].

14 Nicholas Kaldor, ‘Alternative Theories of Distribution’, The Review of Economic Studies, 23, no. 2 (1956), pp. 83-100.

15 Rema Hana, Dispelling the Myth of Welfare Dependency, 9 August 2019 <https://epod.cid.harvard.edu/article/dispelling- myth-welfare-dependency> [Last accessed: 9 June 2020]

16 Ha-Joon Chang, 23 Things They Don’t Tell You About Capitalism (London: Penguin, 2011). This conclusion holds, irrespective of confounding variables.

17 Raghuram Rajan, Fault Lines (Princeton: Princeton University Press, 2011).

18 Progressive income taxation is taken to be a tax scheme applied to a monetary (income) base, whereby the marginal tax rate rises in proportion with said base.

19 Martin Feldstein, ‘The Effect of Marginal Tax Rates on Taxable Income: a Panel Study of the 1986 Tax Reform Act’, The Journal of Political Economy, 103, no. 3 (1996), pp. 551-572.

20 Jon Gruber and Emmanuel Saez, ‘The elasticity of taxable income: evidence and implications’, Journal of Public Economics, 84, no. 1 (2002), pp. 1-32.

21 Nigel Morris, ‘Frank Field: Universal credit is so badly designed it traps families in poverty’, iNews, 15 September 2017.

22 Hugh Dalton, Principles of Public Finance (Oxford: Routledge, 1922).

23 John Hills, Good Times, Bad Times (Bristol: Bristol University Press, 2017).

Notably, ‘fiscal sustainability’ need not equate to ‘balancing the budget’, particularly today, with long-term interest rates the lowest in recorded history. Part of the confusion over deficits comes from treating welfare expenditure as consumption as opposed to investment which brings returns through the multiplier effect, productivity improvements and the avoidance of further costs to the state (healthcare or rent and council tax arrears, for example). The now-discredited Reinhardt and Rogoff study is another contributing factor.

24Tracy Shildrick, Robert MacDonald, Andy Furlong, Johann Roden and Robert Crow, Are Cultures of Worklessness Passed Down Through Generations? (London: Joseph Rowntree Foundation, 2012). In this major study, the Joseph Rowntree Foundation failed to identify a single family in the UK where worklessness had persisted for three or more generations and found that those who were long-term unemployed remained committed to the value of work.

25 Era Dabla-Norris, Kalpana Kochhar, Frantisek Ricka, Nujin Suphaphiphat, and Evridiki Tsounta, Causes and Consequences of Income Inequality: A Global Perspective (Washington: International Monetary Fund, 2015).

26 Edward Wolff, ‘Inheritances and Wealth Inequality, 1989-1998’, American Economic Review, 92, no. 2 (2002), pp. 260-264.

27 Joseph Stiglitz, ‘Notes on Estate Taxes, Redistribution and the Concept of Balanced Growth Path Incidence’, Journal of Political Economy, 86, no. 2 (1978), pp. 137-150.

28 Mikael Elinder, Oscar Erixson and Daniel Waldenstrom, Inheritance and Wealth Inequality: Evidence from Population Registers (London: Centre for Economic Policy Research, 2016).

29 The Editorial Board, ‘Why the UK’s inheritance tax needs to be reformed’, The Financial Times, 12 July 2019.

30 Tobin taxation can therefore be considered a progressive policy and falls within the category of ‘forced redistribution’. 31 Ben Patterson and Mickal Galliano, The Feasibility of an International “Tobin Tax” (Luxembourg: European Parliament, 1999).

32 Chris Rhodes, Financial services: contribution to the UK economy (London: House of Commons Library, 2019).

33 Pierre Chaigneau, The Tobin Tax, 10 July 2011 <https://www.next-finance.net/The-Tobin-tax> [Last accessed: 10 June 2020].

34 Ibid.

35 Allan Meltzer and Scott Richard, ‘A Rational Theory of the Size of Government’, Journal of Political Economy, 89, no.1 (1981), pp. 914-1927.

36 Valentino Larcinese, ‘Voting over Redistribution and the Size of the Welfare State: The Role of Turnout’, Political Studies, 55, no. 3 (2007), pp. 568-585.

37 Michael Norton, David Neal, Cassandra Govan, Dan Ariley and Elise Holland, ‘The Not-So-Common-Wealth of Australia: Evidence for a Cross-Cultural Desire for a More Equal Distribution of Wealth’, Analyses of Social Issues and Public Policy, 14, no. 1 (2014), pp. 339-351.

38 World Economic Forum, The Future of Jobs Report (Geneva: World Economic Forum, 2018).

39 Hans Moravec, Mind Children (Cambridge: Harvard University Press, 1988).

40 Pierre Bourdieu and Jean-Claude Passeron, ‘Cultural Reproduction and Social Reproduction’, in Jerome Karabel and Albert Halsey (eds), Power and Ideology in Education (New York: Oxford University Press, 1977), pp. 487-511. Suggestions range from Johnsonite infrastructure investment to Corbynite company restructuring.

41 In Capital vol. 1 Marx writes that alongside generating intolerable levels of ‘misery, oppression, slavery, degradation and oppression’, the concentration of wealth poses ‘a fetter upon the laws of production’. For the reasons outlined in the first section of this essay, we might consider this to be among his most prescient claims.

Bibliography

Acocella, Nicola, The Foundations of Economic Policy. Cambridge: Cambridge University Press, 2000.

Bourdieu, Pierre and Passeron, Jean-Claude, ‘Cultural Reproduction and Social Reproduction’, in Jerome Karabel and Albert Halsey (eds), Power and Ideology in Education. New York: Oxford University Press, 1977, pp. 487-511.

Chaigneau, Pierre, The Tobin Tax, 10 July 2011 <https://www.next-finance.net/The-Tobin-tax> [Last accessed: 10 June 2020].

Chang, Ha-Joon, 23 Things They Don’t Tell You About Capitalism. London: Penguin, 2011.

Dabla-Norris, Era, Kochhar, Kalpana, Ricka, Frantisek, Suphaphiphat, Nujin and Tsounta, Evridiki Causes and Consequences of Income Inequality: A Global Perspective. Washington: International Monetary Fund, 2015.

Dalton, Hugh, Principles of Public Finance. Oxford: Routledge, 1922.

Editorial Board, ‘Why the UK’s inheritance tax needs to be reformed’, The Financial Times, 12 July 2019.

Elinder, Mikael, Erixson, Oskar and Waldenstrom, Daniel, Inheritance and Wealth Inequality: Evidence from Population Registers. London: Centre for Economic Policy Research, 2016.

Elliott, Larry, ‘Unemployment due to Covid-19 is surely worth more than a footnote.’ The Guardian, 10 May 2020.

Feldstein, Martin, ‘The Effect of Marginal Tax Rates on Taxable Income: a Panel Study of the 1986 Tax Reform Act’, The Journal of Political Economy, 103, no. 3 (1996), pp. 551-572.

Foucault, Michel, The Birth of Biopolitics: Lectures at the College de France, 1978-1979. London: Palgrave Macmillan, 2008.

Hacker, Jacob, The Great Risk Shift. Oxford: Oxford University Press, 2008. Hana, Rema, Dispelling the Myth of Welfare Dependency, 9 August 2019 <https://epod.cid.harvard.edu/article/dispelling-myth-welfare-dependency > [Last accessed: 9 June 2020]

Hills, John, Good Times, Bad Times. Bristol: Bristol University Press, 2017.

Kaldor, Nicholas, ‘Alternative Theories of Distribution’, The Review of Economic Studies, 23, no. 2 (1956), pp. 83-100.

Larcinese, Valentino, ‘Voting over Redistribution and the Size of the Welfare State: The Role of Turnout’, Political Studies, 55, no. 3 (2007), pp. 568-585.

Leaders, ‘Big tech is thriving in the midst of the recession’, The Economist, 2 May 2020.

Leigh, Andrew, Jencks, Christopher and Smeeding, Timothy, ‘Health and Economic Inequality’, in Wiemer Salverda, Brian Nolan and Timothy Smeeding (eds), The Oxford Handbook of Economic Inequality. Oxford: Oxford University Press, 2009.

Norton, Michael, Neal, David, Govan, Cassandra, Ariley Dan, and Holland, Elise, ‘The Not-So-Common-Wealth of Australia: Evidence for a Cross-Cultural Desire for a More Equal Distribution of Wealth’, Analyses of Social Issues and Public Policy, 14, no. 1 (2014), pp. 339-351.

Marx, Karl, Capital: a Critique of Political Economy v.1. London: Penguin Classics, 1990.

Meltzer, Allan and Richard, Scott, ‘A Rational Theory of the Size of Government’, Journal of Political Economy, 89, no.1 (1981), pp. 914-1927.

Moravec, Hans, Mind Children. Cambridge: Harvard University Press, 1988.

Morris, Nigel, ‘Frank Field: Universal credit is so badly designed it traps families in poverty’, iNews, 15 September 2017.

Patterson, Ben and Galliano, Mickal, The Feasibility of an International “Tobin Tax.” Luxembourg: European Parliament, 1999.

Piketty, Thomas, Capital in the Twenty First Century. Cambridge: Harvard University Press, 2014. Rajan, Raghuram, Fault Lines. Princeton: Princeton University Press, 2011.

Rhodes, Chris, Financial services: contribution to the UK economy. London: House of Commons Library, 2019.

Rowlingson, Karen, Does Income Inequality Cause Health and Social Problems? York: Joseph Rowntree Foundation, 2011. <https://www.jrf.org.uk/sites/default/files/jrf/migrated/files/inequality-income-social- problems-full.pdf>

Roy, Indranil, Future of Work: an Introduction, January 2019 <https://www2.deloitte.com/content/dam/Deloitte/it/Documents/humancapital/Future%20of%20Work_Delo itte.pdf> [Last accessed: 9 June 2020].

Shildrick, Tracy, MacDonald, Robert, Furlong, Andy, Roden, Johann and Crow, Robert, Are Cultures of Worklessness Passed Down Through Generations? London: Joseph Rowntree Foundation, 2012.

Srnicek, Nick, Platform Capitalism. Cambridge: Polity Press, 2016.

Stiglitz, Joseph, ‘Notes on Estate Taxes, Redistribution and the Concept of Balanced Growth Path Incidence’, Journal of Political Economy, 86, no. 2 (1978), pp. 137-150. Stiglitz, Joseph, The Price of Inequality. London: Penguin, 2013.

Vandermoortele, Jan, ‘Inequality and Gresham’s Law: the bad drives out the good’, Unpublished thinkpiece for the UN in China, March 2013. <https://wess.un.org/archive/2015/wp- content/uploads/2015/02/dps_paper_vandemoortele.pdf>

Wilkinson, Richard and Pickett, Kate, The Inner Level. London: Penguin Books, 2018.

Wilkinson, Richard and Pickett, Kate, The Spirit Level: Why Equality is Better for Everyone. London: Penguin Books, 2009.

Wolff, Edward, ‘Inheritances and Wealth Inequality, 1989-1998’, American Economic Review, 92, no. 2 (2002), pp. 260-264.

World Economic Forum, The Future of Jobs Report. Geneva: World Economic Forum, 2018.

2022年John Locke论文学术活动已经放题啦!

对其他学科领域感兴趣的同学

可扫码添加微信咨询

免费领取历年相关获奖论文学习

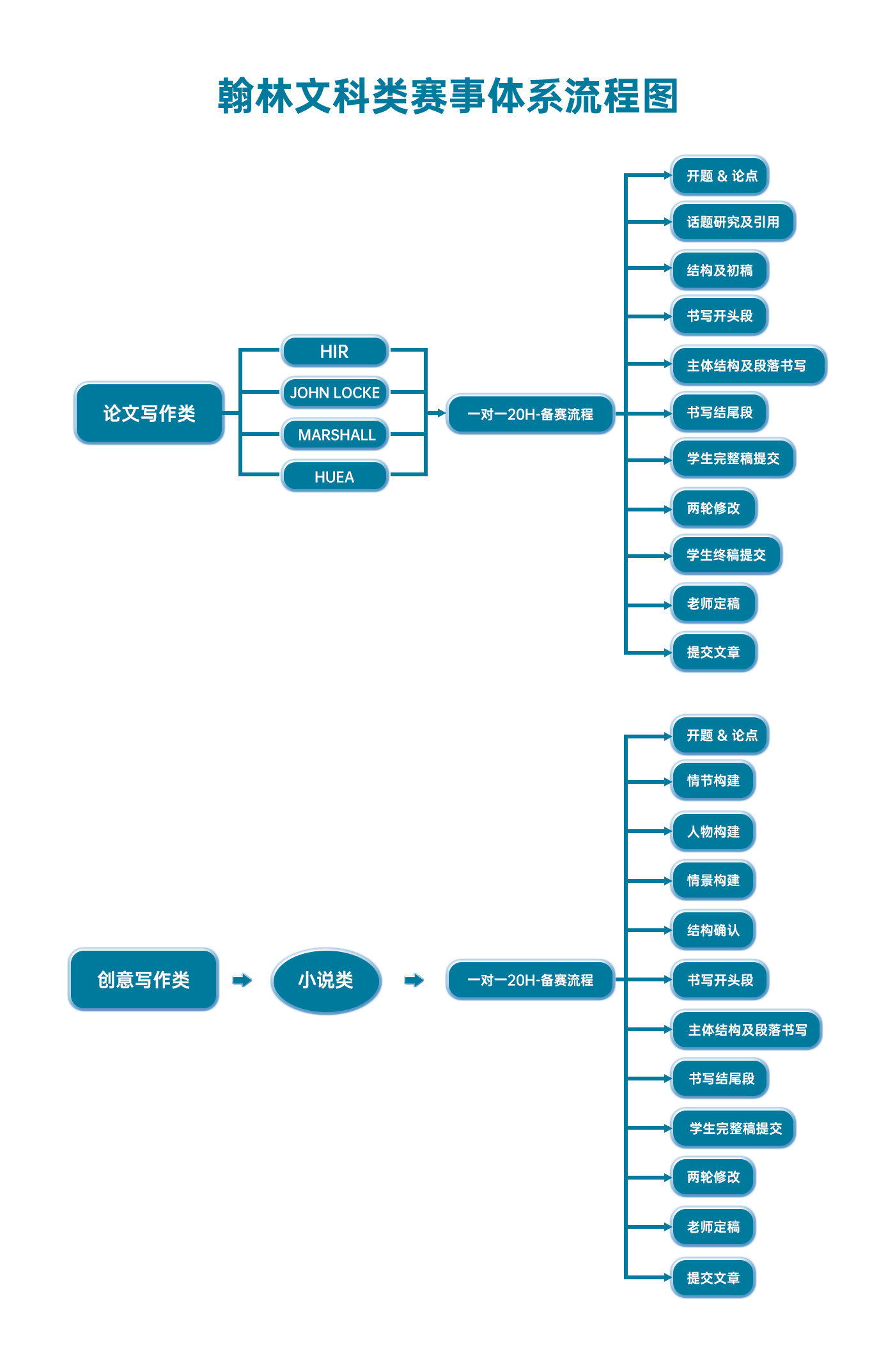

翰林文科学术活动课程体系流程图

早鸟钜惠!翰林2025暑期班课上线

最新发布

© 2025. All Rights Reserved. 沪ICP备2023009024号-1