HIR哈佛国际评论夏季赛已然拉开帷幕!现在正是大家提前做好赛事规划,妥善备赛的好时机!

想要在夏季赛中取得好成绩,写出优秀的分析论文,那么就必须先学习了解优秀的文章有哪些特质。

因此,拥有丰富带赛经验丰富的E导师为大家带来了HIR哈佛国际评论赛2023金奖作品的分析!帮助同学们打开思路,迎战夏季赛!

01、金奖范文分析

我们从往期学子作品中选取了一篇2023赛季金奖范文,结合官方评分标准给大家进行解析参考,可以从中了解评审更看好的逻辑思路,从中学习好的方法论,给大家更多的解题思路。

*想要浏览全文,欢迎联系咨询获取

我要咨询获取

更多信息可咨询顾问

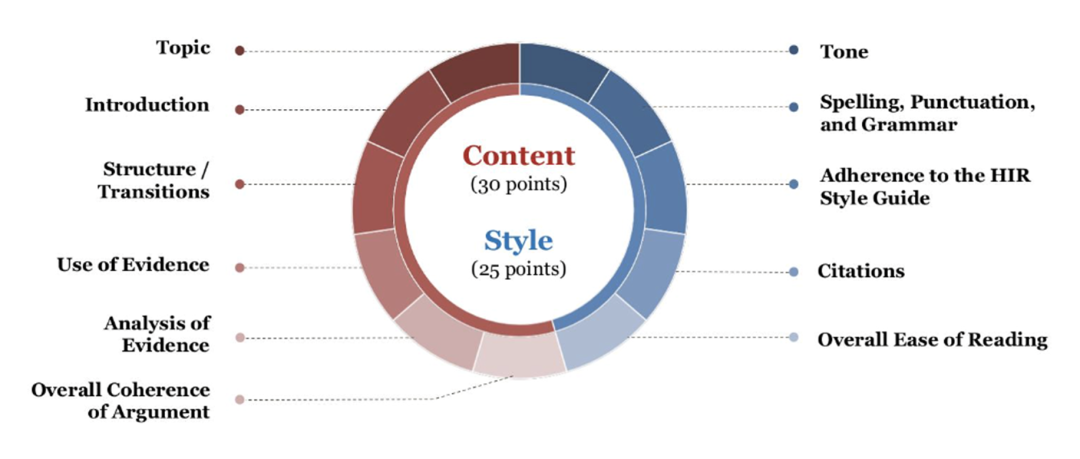

HIR官方评分标准▼

结合官方发布的评分标准,我们一起来解读能够摘得金奖的文章,究竟有哪些可取之处?

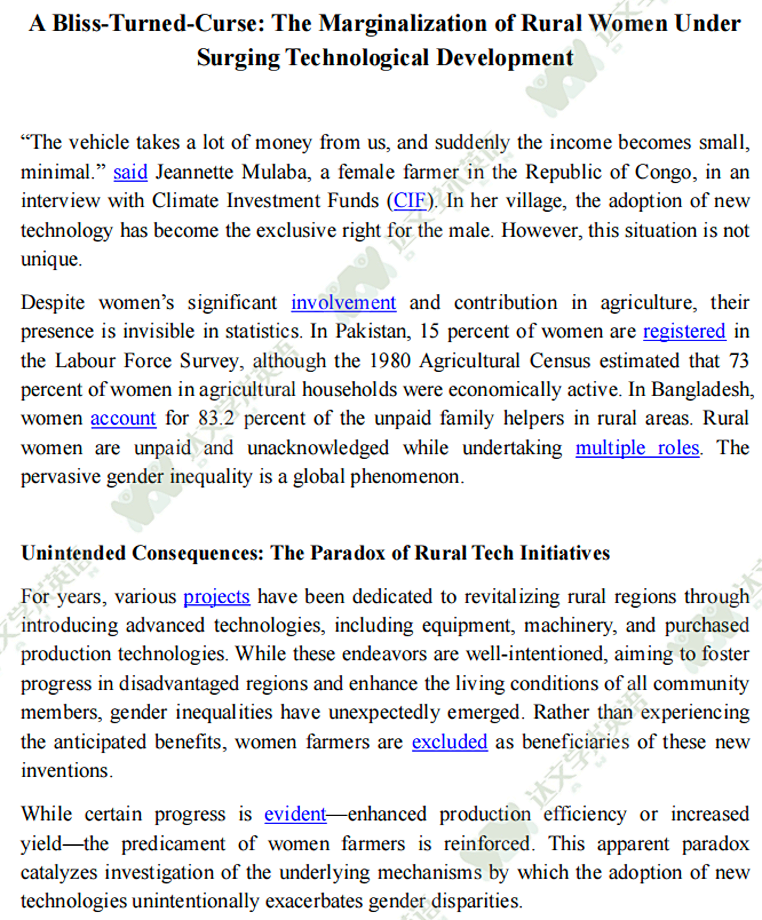

1、选题新颖,切入贴合

联系去年的赛事主题“Technological Advancement and the World 科技进步与世界”,在这篇文章中,学生选择了在主流媒体中低关注度但紧扣赛事主题的话题。

2、引用开头法 + 数据性材料的运用

文章开头直接引用了刚果女农民的采访语录,快速抓住读者的注意力。

并利用统计数据佐证,说明了“技术迅猛发展下农村妇女边缘化”的真实现象。点明主题,并为下文做了很好的铺垫。

3、结构 / 过渡清晰明了

首先文章开头部分不仅做了铺垫,并在结构上起到了总领全文的作用。

而在下文的展开论述中,从联合国相关倡议,到叙述目前真实存在的问题并分析其背后原因,最后提出了可能的解决方案,并做了方案的评估分析。

通篇围绕着科技发展与帮扶对于女性的影响,抛出问题——分析国际、社会层面现象及背后原因——寻求解决之道,分为三个部分,层层递进深入剖析话题,结构明了,逻辑清晰。

4、有深度的信息挖掘 & 透彻分析

整篇文章的证据分析做得很有深度,学生找到并举证了非常多的有力论据,甚至用到了关于低收入群体走出经济困境的理论框架,并以这个理论框架作为理论基础展开了分析。全文的整体论证也做得有理有据。

5、行文流畅,紧扣文章中心

文章中心论点明确,通篇论述紧贴主题,没有赘余,结合严谨的行文逻辑,整体连贯性很好。

6、引用得当,保持客观,可读性强

文章经过再三校对,没有语法错误之外,每一个事实性的声明和他人观点都做到了规范引用。

保证了文章阐述清晰的同时,整体论述风格和分析都呈现出充满人文关怀却始终保持理性客观的基调,使得文章易读又客观。

学习、研究获奖作品,就相当于看一份标准写作指南,能够帮助大家更直观、高效地学习到如何紧扣论文的主题,从各个角度进行深入分析,并最终将自己的观点清晰、准确地阐述出来。

如果大家有机会浏览整篇文章,或者去HIR官网上浏览往年的一些获奖范文,相信能够对于自己如何展开将有很大启发。

02、备赛提醒

HIR是一个自由度比较高的赛事,对于竞赛本身以及参赛要求,我们需要明确知道。如果对于HIR这个比赛不甚了解,请大家一起了解一下这个赛事的背景与相关的竞赛详情~

关于HIR哈佛国际评论赛

Harvard International Review

全球顶级社科学术期刊《哈佛国际评论》旗下,国际问题研究领域学术竞赛标杆。HIR《哈佛国际评论》,成立于 1979 年,致力于通过出色的写作和编辑选择在学术和政策之间架起桥梁。曾收录了43 位总统和总理、4 位秘书长、4 位诺贝尔经济学奖获得者和 7 位诺贝尔和平奖获得者的专题评论。

命题领域

自命题学术论文,主题不需要出现在文章题目或内容中,命题方向包含但不局限于:农业、科技、网络安全等13个领域。

参赛详情

【参赛资格】

全球9-12年级高中生

【参赛时间线】

夏季赛报名截止日:2024年7月25日

夏季赛提交截止日:2024年8月31日

夏季赛决赛答辩日:2024年10月5日

参赛要求

【字数限制】

字数800-1200(不包括图表、数据表或作者声明)

【内容议题】

提交的内容应针对某个不被关注的全球性主题,提出自己的观点并进行充分的分析论证。

【写作风格】

优秀的参赛作品需要具备全面性、批判性,遵循事实情况,进行合理地论证与分析。

- 标注对书籍和文献的引用

- 文章必须是AP风格

【答辩环节】

公布入围名单后,入围参赛者即为决赛入围者,需要在答辩日,向评委会进行 15 分钟的演讲和口头答辩

● 注意赛事时间线与时差务必注意赛方时间是基于美东时间,各个节点日期当天的11:59 P.M. (EST)。同学们做赛事规划务必考虑到时差,避免错过时机哦~

● 赛事设有答辩环节在公布入围名单后,入围同学则自动进入“决赛圈”,需要筹备完成15分钟左右的答辩,突围冲奖!同学们需要有所准备哦!

我要咨询/报名

更多信息可咨询顾问

03、推荐阅读

从HIR赛事官网,我们也选取了几篇不同领域的范文,大家可以进行学习、参考。

01、Unhealthy Economy, Unhealthy Bodies: Egypt’s Obesity Epidemic

Finance & Economics

Law & Diplomacy

The obesity epidemic has become a global burden, and it is generally expected that the countries with the largest appetites have the most voracious economies. In the United States, it is estimated that around 41.9 percent of the adult population in 2020 was obese, and obesity has become the second-leading cause of preventable deaths. Obesity is strongly correlated with various debilitating diseases, leading to the death of four million people annually. Within 30 years, the global population of those suffering from obesity has quadrupled from four percent to 18 percent.

However, the conception that countries with the highest obesity rates are only the most developed is a fallacy, as more money is correlated with more access to healthy foods. In reality, a multitude of underdeveloped countries suffer to an equal or similar degree when it comes to confronting obesity, Egypt having been in the top ten.

Egypt currently battles hundreds of billions of US dollars in national debt and rising health complications as more Egyptians are diagnosed with obesity. How has a nation with a serious financial crisis developed an obesity issue?

A Medical Fallacy: Egypt’s Economic Quagmire

While Egypt has received praise for its 45th international ranking with a GDP of US$250.9 billion, this recognition is diminished by the ever-increasing national debt. In 2022, Egypt reached a high of US$422 billion in national debt. Yet, with a clear lack of funding for overall development, the nation has managed to suffer from a “developed” country issue: obesity.

Looking forward, the overall national debt is predicted to increase from US$276.11 billion in 2024 to US$316 billion in 2025, with debt as a percentage of GDP only expected to decrease from 96.37 percent in 2024 to 82.62 percent in 2025. GDP is only expected to grow an average of 5.4 percent in five years. Egyptians are concerned about continuous loans from the International Monetary Fund, the World Bank, as well as other countries. Particularly, Egypt will have to balance this difficult financial situation with the needs of a growing population.

Moreover, the economic crisis is exacerbated by vast inflation. The stark contrast between Egypt’s average monthly income, US$342 per capita, and that in the United States (US$6,398) is augmented by-product costs. When comparing the nations’ pricing, US goods are found to cost 76.3 percent less than Egypt’s—a single demonstration of the drastic inflation crisis the country is currently experiencing. Therefore, the gap in per capita purchasing power is even higher than the gap in per capita income.

With a currency that has been devalued by above 50 percent (in comparison to the US dollar) and food inflation that has breached 60 percent, one might fear starvation or malnutrition. However, the nation’s unfortunate confluence of low wealth, disproportionately high prices, and low quality of life has continued to coexist with a devastating obesity crisis.

In 2022, Egypt was ranked seventh among the most obese countries with 21,670,640 obese people. After screening around 49.7 million Egyptians, the Institute for Healthcare Improvement determined in 2019 that close to 39.8 percent of the adult population was obese—strongly correlated with the 62 percent of males with Type 2 Diabetes, 13 million people with sleep apnea, six million people with hypertension, and a plethora of other health complications related to obesity.

Contributing Factors: Obesity in Egypt

White sugar on a metal spoon. Photo by Alexander Grey / Unsplash.

Egypt is one example of the scientific phenomenon of “nutritional transition”: when economic, demographic, and other external factors cause a society to alter its traditional nutritional intake.

In Egypt, this dilemma affects all socioeconomic classes. Food inflation being over 60 percent has forced citizens to adjust accordingly. Families desperately prioritize the feeling of being full rather than meeting nutritional requirements. Focused on immediate survival, Egyptians opt for low-cost, high-calorie meals. Diets have transitioned from rice, vegetables, legumes, and spices to meats, carbohydrates, and sugar-heavy dishes. The Egyptian government has even recommended that people consume chicken feet instead of chicken meat.

Multiple political and economic factors have exacerbated this crisis. For instance, the Egyptian government subsidizes sugar and oil-based products rather than healthier alternatives, which is worsened by shops providing unhealthy snacks at lower costs. Many societal customs of Egypt are founded upon food; adding sugar to dishes or participating in grandiose meals is a cultural norm. Socioeconomic inequality also plays a role, for Egyptians with lower education (i.e., with a high school diploma or lower) and financial status are three times more likely to be obese.

Confoundingly, of these factors, the Egyptian government’s food subsidy program is the prominent cause of obesity in the population. Despite the economic disparity within the nation, obesity rates are fairly even across socioeconomic classes in Cairo. To combat the inflated food prices and prevent nationwide starvation, the subsidy program has focused on subsidizing bread, wheat flour, sugar, and cooking oil for the last 25 years. Those same items have been long recognized by health officials as fattening, with sugar supplanting the much-needed consumption of protein and fiber. This program is widely accessible to more than 80 percent of the population, so participation has led to these high-calorie items becoming common staples in the traditional kitchen.

These adverse effects of the government’s subsidy program are exacerbated by private sector practices. Egyptian restaurants that cater to late-night deliveries encourage consumption at all times of the day. The timing of this late-night dining not only deviates from the normal consumption hours but also the circadian rhythm that allows for digestion, causing the body to store the late-night meal into fat.

The Future of Fitness

Various proposed policies and health official opinions have sought to address this colossal dilemma threatening the health and survival of over a third of Egyptians. In 2018, the Ministry of Health and Population implemented the Egypt Multisectoral Action Plan For Noncommunicable Diseases Prevention (NCD) and Control 2018-2022. This initiative worked towards nine voluntary global NCD targets, including a five percent decrease in physical inactivity, a 20 percent decrease in salt consumption, and a 15 percent decrease in hypertension, diabetes, and obesity.

In addition to these sweeping measures, some medical professionals are recommending a more direct plan focusing on the youth. “Fighting this starts in schools…I know we’re not doing great economically right now, but nutrition classes and subsidizing one fruit or vegetable per day per child would give them something they don’t get at home,” states Egyptian dietician Dr. Sherine el Shimi. Similarly, Dr. Randa Abou el Naga of the Egypt World Health Organization (WHO) recommends government subsidies for more nutritionally rich products or ingredients that contribute to muscle development rather than the current options of sugar- and carbohydrate-intensive snacks. When the food most financially accessible is that of the greatest nutritional value, citizens will not be forced to sacrifice their savings for a healthy meal.

Ultimately, the coexistence of low economic growth and high obesity rates persists, as low- and middle-income nations are suffering most from high obesity rates, with Egypt previously ranking seventh with 32 percent of its youth population obese. Although Egypt is now 28th in the world for obesity prevalence, the overall obesity rate has actually increased from 31.3 percent in 2011-2012 to 35.7 percent in 2024. Egypt is one of many countries proving that obesity is far from a “developed country issue.”

链接:https://hir.harvard.edu/unhealthy-economy-unhealthy-bodies-egypts-obesity-epidemic-2/

02、Shifting Eurasian Energy Politics

Energy & Environment

Trade

Finance & Economics

As the war in Ukraine surpasses the one-year mark, the effort to divorce Russia from its oil supplies is still going strong. But some are asking: Is it working? Trying to bring the Russian economy to its knees, the US and its allies haveescalated sanctionson the Russian economy. While many aspects of the sanctions packages have seenmixed results, it is clear that measures aimed at distancing the West from Russian energy supplies will form the crux of the attempt to punish Putin’s regime.

The Russian economy, and that of its predecessor the Soviet Union, have long relied on oil and gas revenues to prop up the country’s economic fortunes and to pay out the costs of geopolitical competition. The war in Ukraine requires increased Russian expenditures and therefore will cause the Russian government to look for other customers for its energy supplies. Though the full effects of the European decision to reduce Russian oil and gas have yet to be seen, it is clear that Russia is beginning to look towards growing Asian economies to fill the gap in its coffers.

How receptive Asian and Middle Eastern nations are to Russia’s overtures may signal the extent of Washington’s success in cordoning Russia off from world markets.

Tough Business

The importance of energy revenues to the Kremlin cannot be emphasized enough. In the early 2000s, a time in which Putin managed to consolidateone-party rulein the Russian Federation, major federal budgetsurpluseswere due in large part to high oil prices (pre-2008). Reorganizing the finances of the Russian Federation and ensuring the stability of the country’s pension system could be made possible by taking advantage of the country’s vast energy resources and potential. In writing an article on the importance of energy revenues to the country’s status as a great power in 1999, a younger Putin argued that thedistributionof the profits could ensure better living conditions for the Russian people. The added benefit, of course, is that it can also discourage protests against the reigning regime. Clearly, the growth and maintenance of Putin’s domestic control is incumbent on bringing in high profits and spreading the wealth from nationalized industries.

Even as political relations worsened, energy had previously remained a sphere of cooperation between Russia and Europe. Yet, on June 3rd, 2022, as part of the sixth package or round of sanctions on Russia for its invasion of Ukraine, the European Union adopted a partialembargoon Russian oil. Despite the rocky relationship that had existed between the EU and Russia after Russia’s seizure of Crimea in 2014, the supply chains from Russia to Europe, particularly the energy-hungry economies of Western Europeremained. Therefore, the decision to embargo Russian oil was a major step for the European Union in confronting Russia over its aggression in Ukraine. As a result of theunprecedented condemnationof Russia’s large-scale land war, policymakers across the European continent were able to come together and get the needed votes to agree on limiting Russian energy imports.

To reduce dependence on Russian energy but avoid complete chaos in world energy markets, transatlantic leadersdecidedthat the aforementioned energy embargo would only go into effect months later in December 2022. That delayed implementation gave European energy providers some time to find alternative energy sources. But that task hasn’t proven straightforward. Russia’s proximity and already-built infrastructure meant that Europe did not need to look farther afield, until very recently. As Europe scrambled to find new sellers, Russia has sought out new markets for its plentiful energy resources.

New Customers?

Europe’s decision to divest from Russian energy supplies has forced the Russian Federation to look for alternative buyers in order to fill rapidly depleting state funds. A recentreportfrom Forbes Ukraine pegged the total cost of the war at somewhere around US$82 billion. Given that estimating such a complex sum is difficult to make cumulative, and also that the war is showing no signs ofending, the need to come up with revenue is significant for the survival of the current Russian regime, and also to achieve the Kremlin’s war aims. Since international companies haveleftthe country in droves, less revenue is available from the financial and manufacturing sectors. Therefore, leveraging its vast resources has been and will continue to be a major focal point for the Russian government.

Therefore, the question is, if not Europe, where can Russia sell its oil and gas? The first (and perhaps most obvious) place where Russia will seek to increase its contracts is in China. Given thatenergy tiesbetween the two countries date back decades and China’s economy has been stablygrowingsince ending their covid-lockdowns. The Russian oil and gas fields in Siberia are ideally situated to cater to the large cities and industrial plants in Manchuria and even farther afield, Beijing. On the diplomatic front, China has notcompliedwith the price caps put in place by European leaders to stop Russia from earning energy revenues there and has come out against them.

In 2014, thecompletionof the ‘Power of Siberia’ pipeline connecting gas fields in Irkutsk and Yakutia to China proved a milestone in facilitating such trade. In the present, as Russian gas company Gazprom scrambles to find new markets, this pipeline has served as a medium for a new contract. Press reports from Gazprom late in 2022 indicate that after a call from the Chinese state gas company CNPC to increase supply from Russia, record daily gas flows wererecordedon December 9th, 2022. As ‘Power of Siberia’ ramps supply to hungry Chinese markets, a new pipeline is in the works: ‘Power of Siberia 2’. Taken together, the recent flurry of diplomatic overtures to China and the construction of a new pipeline to be operational in 2030 indicate that Moscow views the future of LNG and oil sales to lay in selling to Asian economies via the Russian Far East.

In aiming to sell in the East, Russia is not only looking to sell to China. Initially pressured by the West to break ties with Russia, India has remained interested in importing Russian energy supplies. India imported Russian oil inrecord quantitiesthroughout 2022, benefitting from the discounted prices. In an interview with Foreign Policy, Shivshankar Menon, former Indian national security advisor, underlined the deep energy ties between the two countries. He noted that Indian firms collectively have invested around US$16 billionin the Russian oil industry. Such deep investments indicate that even if the war drags on and the West continues to reduce consumption of Russian oil and gas, New Delhi will remain a key customer for Moscow. Besides China and India, other Asian nationsimportinglarge amounts of Russian oil and gas include South Korea and Japan.

An Unexpected Lifeline

As Russia hunts for new customers, it has already caught several breaks. The first is surprising cooperation from the Gulf countries, which are US allies but also participate in OPEC alongside Russia. The UAE and Saudi Arabia both embarrassed the United States when theymaintainedrobust relations with the Russian Federation after Western pressure to cut those ties following the brutal invasion of Ukraine. In the summer of 2022, Russia and India were able to use the UAE currency, the dirham, toconductan energy deal. A port in the Emirates, Fujairah, hasprocessedsome of this Russian oil heading to South Asia. Indeed, the Gulf has lent Russia an outlet for conducting energy geopolitics with a freer hand outside of Europe.

The decisions of the Gulf states to continue partnering with Russia in OPEC and in oil refining/storing operations did not go unnoticed in Washington. In late 2022, a diplomatic row between Riyadh and Washington caused President Biden to directlyaccusethe Saudi government of assisting the Russian war effort and mentioned that there could be ‘consequences.’ Further rifts between Saudi Arabia and the US could pave the war to even deeper ties between Russia and the Gulf region. That would force the US into an even more challenging position in severing Russia from global energy markets. This decision reinforces aperceptionby many third parties to the conflict that supporting the principle of national sovereignty and reinforcing the US opposition to the Russian invasion to the detriment of one’s own economy may not be a choice that some countries are willing to make.

A New Eurasian Energy Equilibrium?

Growing pressures on natural resources and rapid economic growth result in a desperate need for energy supplies not only in China and India but elsewhere on the Eurasian landmass. The eagerness displayed by these customers for greater supplies of oil and natural gas indicates that Russia will still be able to raise revenues for its ongoing invasion of Ukraine, even if the West cuts itself off completely of Russian oil and gas – a prospect that may not be out of the realm of possibility. This not only raises important questions for Western efforts to help Ukraine win the war, but also underscores the growing influence of countries like India and the UAE in geopolitics. Despite close ties to the US and European states, those nations have not adopted the Western positions on the Russo-Ukraine war. These conditions no doubt pose questions about the strength of US influence on Eurasian politics.

Russia’s ability to find new customers, to some extent, argues for the US to adopt nuanced approaches to crippling the ability of the Russian state to fund the war in Ukraine. US leaders have underscored the grotesque human cost and grave blow that this war strikes to international law. US President Joe Bidenarguedthat “This world should see these outrageous acts for what they are” before the UN at the 77th Session of the General Assembly. At a Quad summit earlier that year, he madespecial effortsto encourage Delhi and Tokyo to take harder stances against Russia. Given that Russia continues to sell copious amounts of gas, US leaders may look to offer sweeter energy deals to prospective partners in Africa and Eurasia as a more convincing path to divorce Russia from large oil and gas revenues. With interest in clean energy on the rise globally, the Biden administration may have more tools at its disposal than it thinks to combat the global energy crisis. Taking the lead on driving clean energy technologies at home may be a long-term but necessary strategy for Washington to counter Moscow’s influence in worldwide energy markets. What is clear, however, is that whoever provides the world’s most populous countries with energy will gain a great advantage in the coming years.

链接:https://hir.harvard.edu/shifting-eurasian-energy-politics/

HIR哈佛国际评论写作赛的主题始终围绕着人类命运共同体的相关话题展开,并且是自命题,可选择领域也是非常广泛~

对于国际文科竞赛还不大熟悉的同学来说,不失为一个很好的新手选择~

不论我们是想要检验自己写作能力水平,或者是对时政话题感兴趣,有自己的观点想法想要表达,或者是看重哈佛背书这一背景,希望通过参赛借力,冲击顶尖名校,HIR都是一个非常不错的项目~

这个暑假,让我们一同直面挑战,收获成长,蜕变成更好的自己!

我要咨询/参加HIR夏季赛

更多信息可咨询顾问