- 翰林提供学术活动、国际课程、科研项目一站式留学背景提升服务!

- 400 888 0080

2024NEC Critical Thinking案例已发布!AS组中国站CT案例及破题思路来了!

3月份,备受关注的NEC复赛已开幕了!

主办方已于2月24日对所有晋级的选手公布Critical Thinking题目!

图片来自:SKT官微

图片来自:SKT官微

根据赛程,从案例发布到成果提交(3月4日)只有短短10天,时间非常紧张,如何在这10天内解题是所有选手都面临的问题。一起来看看如何破题!

NEC2024中国站日程安排

NEC由CEE(Council for Economics Education)美国经济教育学会举办,发起于2000年,是具有历史沉淀的中学生经济学术活动。

NEC 2024中国站云端峰于山东青岛重启线下!

DR组别:2024年3月15日-3月17日

AS&PRE组别:2024年3月22日-3月24日

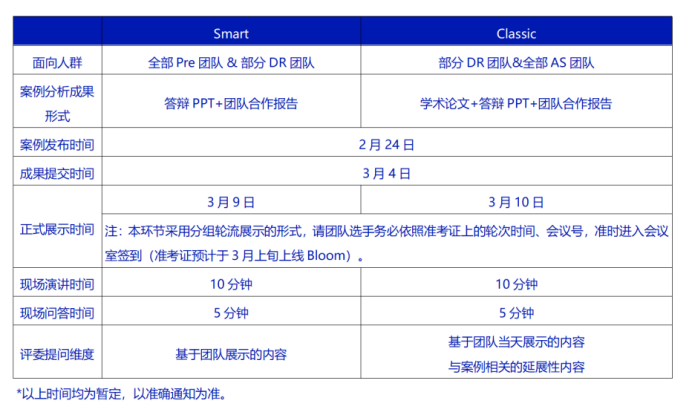

01CT案例大剖析环节重要时间点

02Critical Thinking 案例大剖析 | 赛制介绍

NEC Critical Thinking 案例大剖析环节是一项团队合作任务。每个团队将在这一环节中,针对某个经济学问题或案例进行符合逻辑的分析并提出解决方案。演讲当天,团队将实时连线评委,以PPT的形式展示团队分析成果,并回答评委提出的相关问题。本环节共分为两个模式,Classic模式和Smart模式,以团队为单位计分。两个模式独立进行评比,只有Classic模式的团队才有资格角逐 NEC 2024 全球赛的晋级资格。

Classic模式

面向DR/AS组别的学生

难度较高,适合经济学基础较扎实的学生

需要提交学术论文、成果展示PPT、团队合作报告

评委将基于团队展示的内容以及与案例相关的拓展性内容进行提问

Smart模式

面向Pre/DR组别的学生

难度较低,适合经济学知识储备相对薄弱的学生

只需要提交成果展示PPT、团队合作报告

评委仅基于团队展示的内容进行提问

免费获取NEC活动资料扫码咨询,NEC课程详询顾问老师

03NEC-AS中国站问题&破题思路

⭐AS - Classic Mode问题:金融科技

ISSUE

Economists have studied investment as one of the major components of GDP and economic growth for years. Recently, financial technology (FinTech) has drastically altered financial markets, especially in countries such as China. While some standard models (such investment models accounting for uncertainty) explain patterns in the FinTech sector, the rapid pace of innovation has demonstrated a need for additional analysis of this new type of investment.

PROBLEM

FinTech has presented many new opportunities, as well as challenges, to businesses, policymakers, and regulators. FinTech provides easily accessible loans through online e-platforms, peer-to-peer (P2P) lending opportunities, new digital banking products and procedures, and non-traditional microfinance loans such as car equity loans to small business owners and low- to middle-income families. Each of these new FinTech products comes with risk and uncertainty given the rapid pace of innovation. As businesses attempt to assess their portfolios and policymakers attempt to assess the financial regulatory framework, a number of questions remain unanswered. As a result, recent regulations in China have placed many new limits on FinTech, such as closing P2P platforms, enacting strict and specific regulations on microfinance, and increased oversight of digital banking products.

由于篇幅有限,

完整版赛题+论文&PPT格式要求

扫上文二维码免费领取

⭐破题思路:

金融科技(FinTech)的快速发展正深刻改变金融市场。随着金融科技借贷的普及,我们需深入探讨其对传统银行业、经济增长、投资机会以及低至中等收入家庭的影响,并提出相应的政策建议。

金融科技借贷对经济的影响是广泛而复杂的,需要全面考虑各方面因素。政策制定者、企业领袖和监管机构应密切关注金融科技借贷的发展,并采取有效措施,以确保金融体系的稳健发展。

早鸟钜惠!翰林2025暑期班课上线

最新发布

© 2025. All Rights Reserved. 沪ICP备2023009024号-1